Safeguarding Your Agency

- elin9975

- Aug 5, 2025

- 4 min read

Webinar Summary - July 2025

Thank you to all who attended our webinar last week, organised jointly alongside Deb Murphy from the FCSA who generously gave her time and knowledge. It was brilliant to see a mixture of valued businesses, great questions from attendees and hopefully gave a thorough insight into what’s happening.

For those who would like a recap, we’ve set out the topics covered below.

Background

For several years, various government departments (and successive governments) have been presiding over calls for evidence and a consultation, aimed at looking into regulating the Umbrella market. After the Autumn Budget in 2024 and the announcement of ‘Option Three’ (a proposal which would have created complications for the recruitment and Umbrella industry) the FCSA formed and lead the Industry Working Group – REC, APSCp, TEAM, Software Providers, Umbrellas and other interested parties. Rebecca Seeley Harris, a well respected tax policy expert was also engaged to work alongside the group to work on alternative solutions. After months of meetings with HMRC, The Treasury, MP’s and Peers, the proposed ‘Joint and Several Liability’ solution was published in the draft Finance Bill in July 2025, which will now become government policy. This is welcomed by all who operate compliantly in the industry, to level the playing field and provide transparency throughout the supply chain.

What is happening in April 2026?

A new Chapter 11 of ITEPA sets out the tax liability rules for the industry effective from the 6th of April.

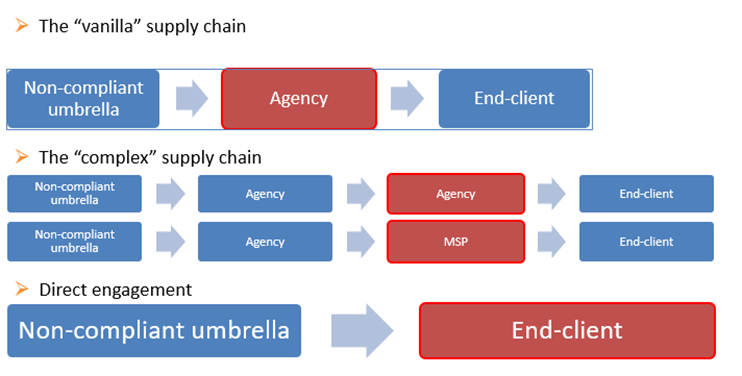

Joint and Several Liability (JSL) means that relevant parties in the supply chain (agencies, end-clients) will share liability for PAYE payments made through Umbrella companies. This applies to the whole amount due, including any shortfalls/underpayments, and also includes the Apprenticeship Levy (soon to be the Growth & Skills Levy).

A hard line is being taken – there are no statutory excuses, regardless of the reason, and the legislation will automatically apply. Offshore entities in a supply chain will be ignored, with scrutiny on the next closest UK based company in the chain, so the government have sought to cover all bases. No-one is exempt!

They’ve also announced a broad definition of ‘Umbrella companies’ to include employment businesses and intermediaries directly engaging workers under a contract of service (employment), but recruiters are not being deemed ‘the employer’.

The Employer Registration Number in use will still be the Umbrella’s, and all liability and responsibility for employment law and employee rights will still be the Umbrella’s. This means it’s business as usual with no employment contract changes required, and no changes required to Key Information Documents – just make sure you are sending them!

The Relevant Party – what does this mean?

The legislation makes reference to the ‘Relevant Party’, which suggests that the topmost agency in the chain (the one with the contract with the client) appears to be the entity that becomes liable if there are multiple agencies involved.

If there’s no agency involved, then the end-client will be held liable. But if the MSP or agency is ‘connected’ to the Umbrella (common directors or shareholders) then the end-client is still liable. Ditto with if the topmost agency isn’t UK based – the end-client may still be liable. MSP’s are included, even if they’re not in the payment chain.

‘Purported Umbrellas’ – what does this mean?

The draft legislation coined a new phrase of ‘purported Umbrellas’. It’s a broad definition and appears designed to catch;

Mini-Umbrellas

Fraudulent arrangements which utilise compliance loopholes

Unlawful gross pay models (such as false self-employment)

Proof here that the government is again trying to cover all bases, and ensure robust compliance throughout the chain.

Is this changing CIS or IR35 rules?

The genuinely self-employed, and those who are deemed to be employees for tax purposes under Chapters 7 – 10 of ITEPA (which covers the agency worker tax rules, IR35, Managed Service Companies and off payroll working rules) are excluded from the new Chapter 11, with those existing Chapters taking precedence. Put simply, no change to current rules here.

What can I do to de-risk?

As we’ve said before, by using Clipper, you’re off to a great start, so by and large, nothing operationally should have to change.

Some other considerations would be;

Ensuring your PSL is an Assured Provider List of FCSA accredited providers.

Speak to the FCSA and become an FCSA Recruiter Partner and get insights and mitigation tools direct from us (if already a Recruiter Partner, you can get help on building on your existing process).

A strong, well-documented and proactive due diligence process is essential.

Work with your provider(s) to ensure trust and mitigate risk.

Don’t fall for unrealistic incentives – they are not affordable for a compliant umbrella.

What will be the effects?

We can expect to see some behavioural changes in the industry;

End-clients and MSPs/lead agencies may require use of FCSA Accredited providers.

A massive uplift in proactive and robust due diligence from all parties.

Using real time payslip auditing tools.

End-clients who are direct to Umbrella potentially starting to use agencies.

End-clients perhaps requiring that PAYE in house agency workers are shifted to Umbrellas.

Clipper have 16 years of experience navigating and implementing various legislation changes, and we’re still going from strength to strength. For more information on how we can guide you through the next few months, please get in touch.

Comments